Commercial Property & Casualty Business Insurance Solutions

Insurance with purpose Agency

We’re here to help you with any challenges you face in managing your business risk exposures and insurance needs.

Common Coverages

Business Insurance Property & Casualty Products

Dominique Renaud –

President –

Insurance With Purpose Agency, Inc.

It’s time for you to experience the next level of insurance service

- There are many different roles that a great insurance agent should play, and service should not stop when your policies go into effect

- From Pre-market to Post-market, I am dedicated to providing you with the level of service you deserve, but may not even know you need

- See what the next level of insurance service is all about

Dominique Renaud – President – Insurance With Purpose Agency, Inc. 2024.

Some highlights

Over 30 years of experience helping various businesses navigate complex insurance requirements in Houston

Senior Vice President of Sales with Assured Partners of Houston, LLC 2019-2024.

President of Houston Business Insurance from 2003 – 2019

Owner of Dominique Renaud Insurance Agency from 1990 – 2007

Certified Marine Insurance Professional CMIP - Certified Marine Insurance Professional

Focusing on complex insurance needs for a variety of industries

Derek Pierce –

Founder –

Insurance With Purpose Agency, Inc.

It’s time for you to experience insurance with purpose.

- Founder of Insurance With Purpose Agency, Inc., has been working in the insurance industry since 2003

- 100% independent insurance agency based in Navasota, Texas

- Derek and his team of experienced insurance agents are dedicated to providing personalized service and expert guidance.

Derek Pierce, Founder of Insurance – Insurance With Purpose Agency, Inc. 2024.

Ideal Client

- Annual business insurance premiums of $100,000 to $10,000,000 (including all policy types)

- An interest in verifying that their policies are a good fit with their risk tolerance

- The willingness to invest the necessary amount of time to provide the information needed for a thorough analysis and great narrative.

- Determined to earn best-in-class insurance terms, conditions, and premiums

- Interested in quality and a long-term relationship with a trusted advisor

- Interested in running a business as safely as possible.

- Concerned about their employees and the protection of their business

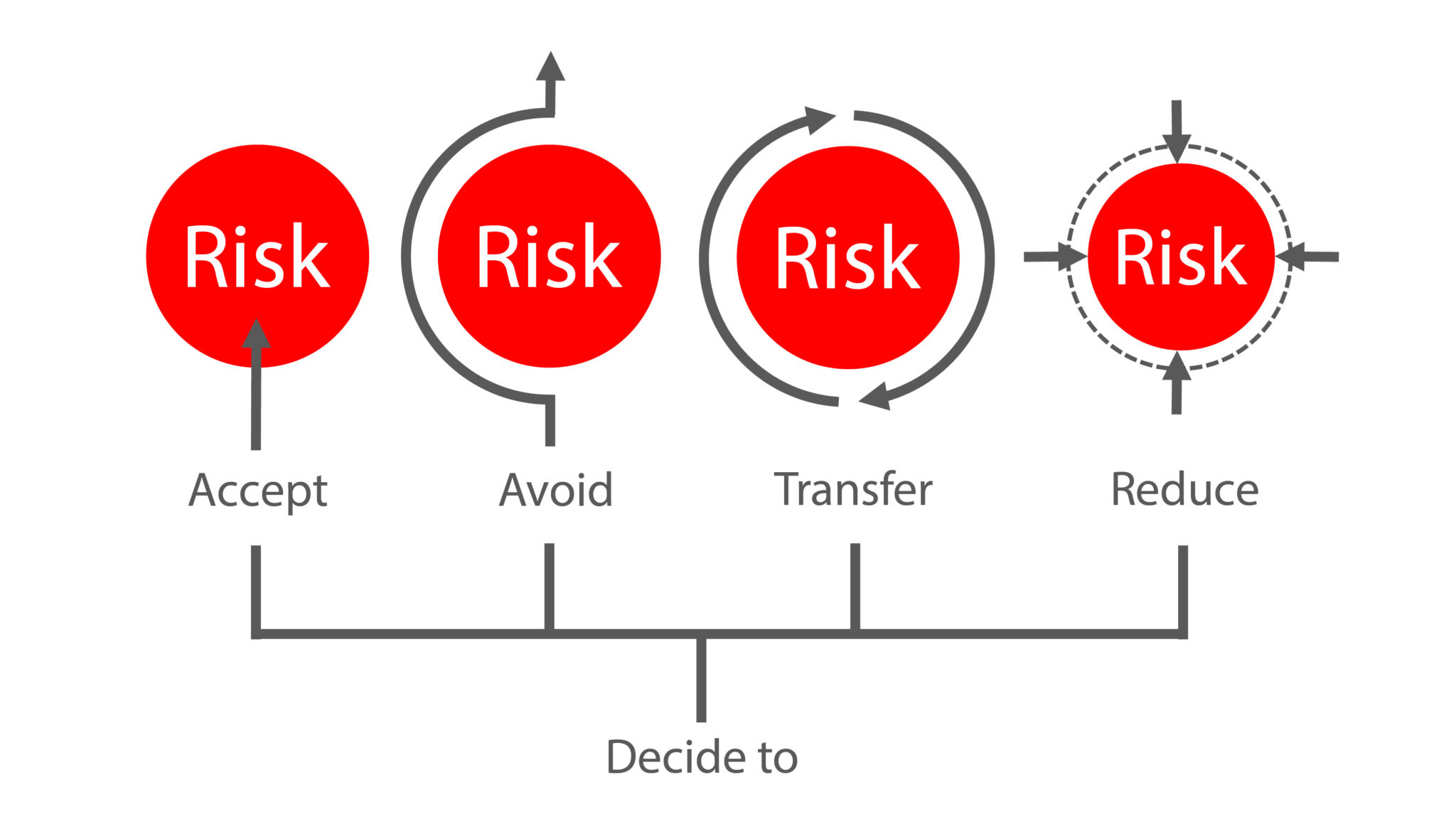

- Interested in proper risk transfer (Inspect what you expect) and therefore making sure that subcontractors/vendors/tenants have the proper insurance

- Willing to listen and understand the objections of underwriters to enable insurance solutions

Next-Level Service

Our agency offers a level of service that begins before marketing your needs to providers and extends well beyond when your policies are issued

Marketing Your business to underwriters

It is critical the underwriters see your business in the best light possible. They need to understand what you do, what you don’t, and how you mitigate risks.

Insurance Sections in Contracts

Many contracts and leases contain insurance requirements. Our agency helps our clients understand the requirements and assess their compliance with them.

Risk Avoidance

Is your business taking the appropriate steps to avoid risks? Just as important, are these correctly communicated to the underwriters?

Certificate Checking

Do contractors or subcontractors working for you, or tenants leasing space from you, have the appropriate insurance in effect? Are their policies current? Do their insurance policies fulfill your contract or lease commitments? Is your experience modifier correctly calculated?

Experience Modifier Analysis

Your experience modifier can positively or negatively impact your premiums and whether or not you are eligible for contracts. We can analyze and help you manage your experience modifier to better reflect your actual risks.

Audits

Annual Worker’s Compensation or General Liability or Rented Equipment Audits are a required component of business insurance. The right preparation can make all the difference and avoid overpayments of premiums.

Claims Management

Claims happen, but how you respond to them and how you mitigate future risks can be critical. We provide a detailed and thorough claims review system that - Identifies where losses are coming from and - Saves money by reducing needlessly high reserves.

Loss Control

There are many actions you can take to minimize losses, both the frequency and the severity. Are the underwriters aware of everything you do from a safety perspective?

Process With Purpose

WHAT WE NEED

Gathering detailed information helps us accurately describe your business to insurers for the best results. Underwriters value precise details, so working closely with us is crucial for a successful application.

SHOPPING YOUR INSURANCE

Our team will carefully look for the insurance you need, often giving you multiple options. If you work with another agency, it might reduce our choices because the market serves the first in line. Also, if other agents don’t accurately present your needs, it could make your search harder. So, we suggest working only with us to get the best results.

PROPOSAL & POLICY

Once we get insurance options, we’ll create and show you a proposal with quotes and answer your questions. After your coverage starts, we’ll take care of your policy and quickly address any changes or issues.

Pre-Market to Post-Market

- Understand you

- Understand your business

- Determine your risk tolerance

- Determine your business’ risk tolerance

- Analyze your current insurance program and discuss the results with you

- Build the proper narrative presenting your account at its best

- Research Potential markets

- Understand risk remediation procedures

- Analyze loss runs

- Analyze your experience modifier

- Understand what you do from a safety standpoint so that it can be communicated to the underwriters

Agency Insights

Our Collection of Informative Articles about the Insurance Industry

Agency Technology

Tools that help us, help you

Online Insurance Applications with Indio Portal

It's a secure, user-friendly online system for completing, reviewing, signing, and submitting documents. This process streamlines applications, ensuring quick and precise data collection for optimal solutions from our team.

Online Policy Management with Applied CSR24 Portal

Get instant access to your coverage proofs, like auto ID cards and insurance certificates, and request policy changes. With our mobile app for Apple and Android, your insurance details are always within reach, keeping you covered & connected 24/7.