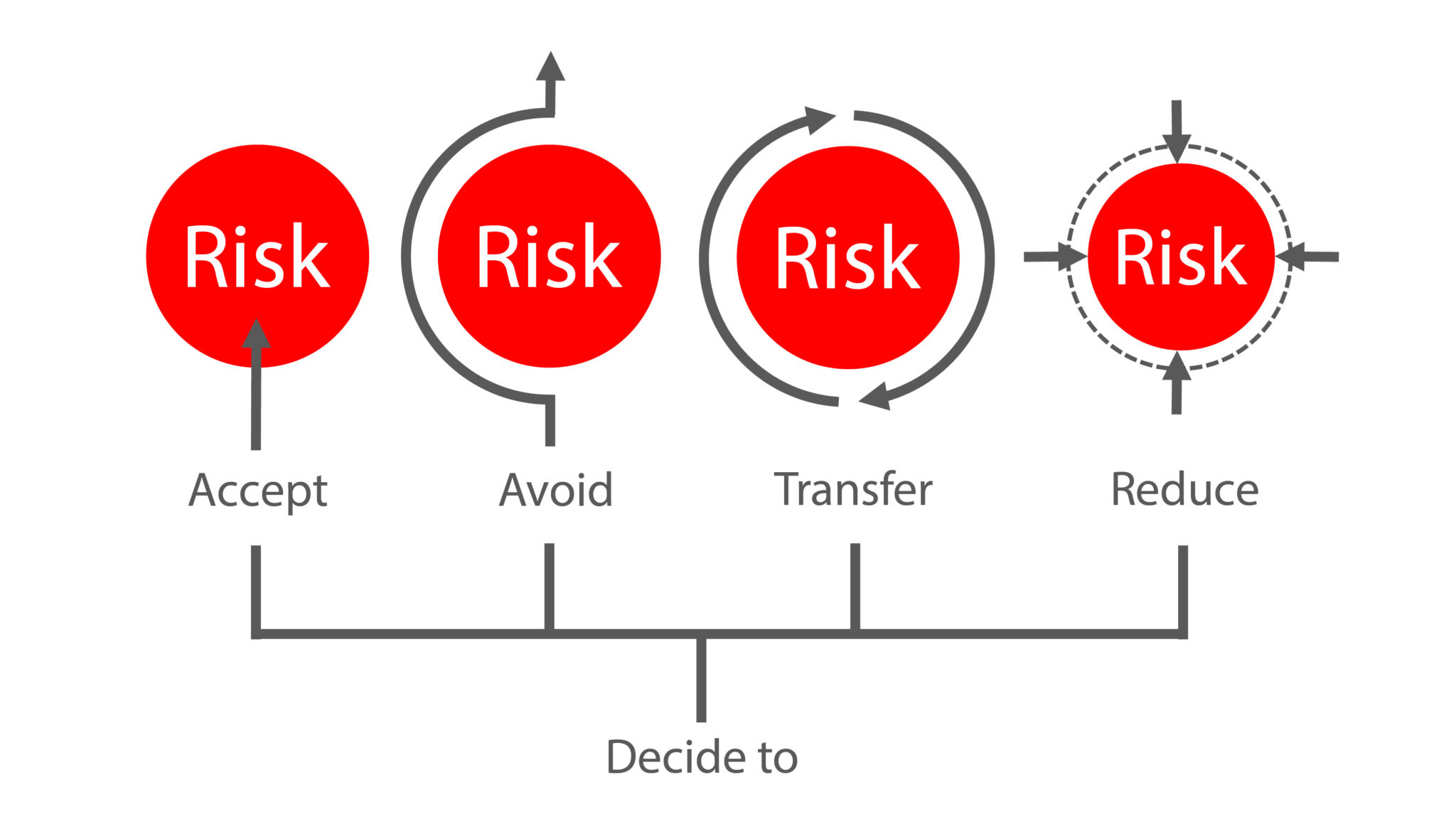

Risk can be anything from a fire destroying your property to the death of a business partner. Insurance aims to transfer risk from one party to another, typically from a business or individual to an insurance company.

While any business requires a degree of risk-taking, the real question is whether you can afford to take on the liability of specific risks. A risk that is outside your experience wheelhouse, or could cause a catastrophic loss, poses a higher probability of financial ruin.

Some activities, events or services can put you at a greater risk for financial loss. These include:

- Construction projects

- Manufacturing operations

- Lease agreements

- Real estate managers

- Professional services

- Third-party service providers and subcontractors

- Venture capitalists and investments

- Business startups

- Mergers and acquisitions

- Suppliers

- Vendors

- Technology

You can transfer your risk using the traditional insurance route, but it might be cost prohibitive based on your situation and the type of risk you’re looking to insure. If you find yourself in this situation, you could skip traditional methods and enter into a private arrangement called a contractual risk transfer (CRT).

What is a CRT?

A CRT is a legally binding way to transfer risk from one party to another. CRTs identify problematic business risks and transfer those risks from one business to another using a contractual agreement. Usually, the business most qualified to handle or control the risk assumes the financial and legal risk liability.

CRTs can help offset insurance costs and create a trust bond between the companies doing business. CRTs put known risk on the table and divide it in a way that makes both businesses feel comfortable.

What is the function of a contractual risk agreement?

Insurance companies tend to shy away from lesser-known risks because they are hard to insure.

For example, some risks don’t have a lot of actuarial data available to predict the likelihood of a claim, even if several businesses are engaging in the same risk. Typically, these are found in emerging markets, making it difficult for an insurance company to know how much premium to charge.

Other risks are one of a kind and require a custom policy (aka bespoke insurance) because the risk is so unique. These come with higher premiums since fewer businesses contribute to the premium pool.

Sometimes the business is hard to insure, as opposed to the risk itself. A company that lacks experience in a particular service poses a greater risk for a claim. Insurance companies may withdraw coverage for that business until they have a proven track record, leaving the business to shop for insurance with companies that charge higher rates.

When risks are too risky, CRTs can come in handy.

Walkway injury: a CRT example

An assisted living residential facility houses elderly residents in a sizeable apartment-style building. The facility hires a third-party maintenance service to handle its landscaping, including walkway and driveway maintenance. The housing staff can’t oversee or inspect the daily landscaping and walkway maintenance. They won’t know if there are immediate hazards on the property, leaving them open to liability.

The facility and the maintenance service enter into a contractual risk agreement that transfers the outdoor maintenance liability from the facility to the maintenance company. The maintenance service promises a specific standard of care and holds the facility harmless if there is a lawsuit.

Later in the year, one of the residents slips and falls on the sidewalk during a visit. The family sues the facility for poor walkway maintenance. The facility’s liability passes to the third-party maintenance service, leaving them with less risk to defend against.

An experienced lawyer specializing in business contracts and risk mitigation can help you draft a CRT agreement like the one in this example.

Who needs CRT protection?

A CRT can be an invaluable tool for most businesses, especially in high-risk operations or when there’s a reliance on third-party service providers. Making sure you’re not responsible for oversights or errors made by a service provider (like in the maintenance service example) can help protect your company from liability outside of your control.

A contract that clearly defines the risks and which party is responsible for them could save your business time and expenses in litigation. It could even save your working relationship with that vendor or provider. Being upfront and clear about who’s willing to take on specific risks before they are part of a lawsuit makes the path to a settlement much more manageable.

CRTs are prevalent in the high-risk construction industry. But as insurance markets harden and nuclear verdicts become more commonplace, CRTs are finding a place across other sectors, too.

What’s in a CRT?

An average risk transfer agreement usually includes the following:

- A hold harmless agreement or indemnification clause outlining each party’s responsibilities, including a duty to defend in court if negligence, personal injury or a damage lawsuit arises

- An insurance procurement clause that specifies who is responsible for obtaining insurance, including the policy types, limits and duration

- A waiver of subrogation clause stating that if the other party’s insurance policy pays a claim related to your business liability, their insurance company waives the right to sue you to recoup damages, even if you were partially responsible

You can also ask to have your business listed as a named insured on your service provider’s insurance policy. Being listed on their policy offers some benefits, like a duty to defend clause in a lawsuit.

CRT considerations

Involve a seasoned contract attorney familiar with your state laws and industry risks. They’ll answer your questions and help protect your business interests before you enter into any signed agreements.

- Avoid overly broad agreements.

- Specify the scope of work and each party’s responsibilities.

- Verify that your contract language complies with your state laws. (A local court could void improper contract language, leaving you responsible. This is especially important when businesses are located in different states.)

- Confirm your state laws regarding negligence and fault. (Some states do not allow you to transfer losses that are partly your fault.)

Ask your insurance agent to review the other company’s insurance policy to ensure adequate coverage. It doesn’t help to be named on an insurance policy that doesn’t afford proper protection.

Call for advice — before you sign

CRTs don’t replace insurance; they supplement insurance programs and help solve some of your trickier risks. If you think a CRT might be a solution for your business, contact the risk trio: your insurance agent, lawyer and accountant. They can offer a comprehensive view of how a CRT could affect your financial, tax and legal liability.